Top 10 Global Temperature Sensor Market Leaders — 2025 Guide

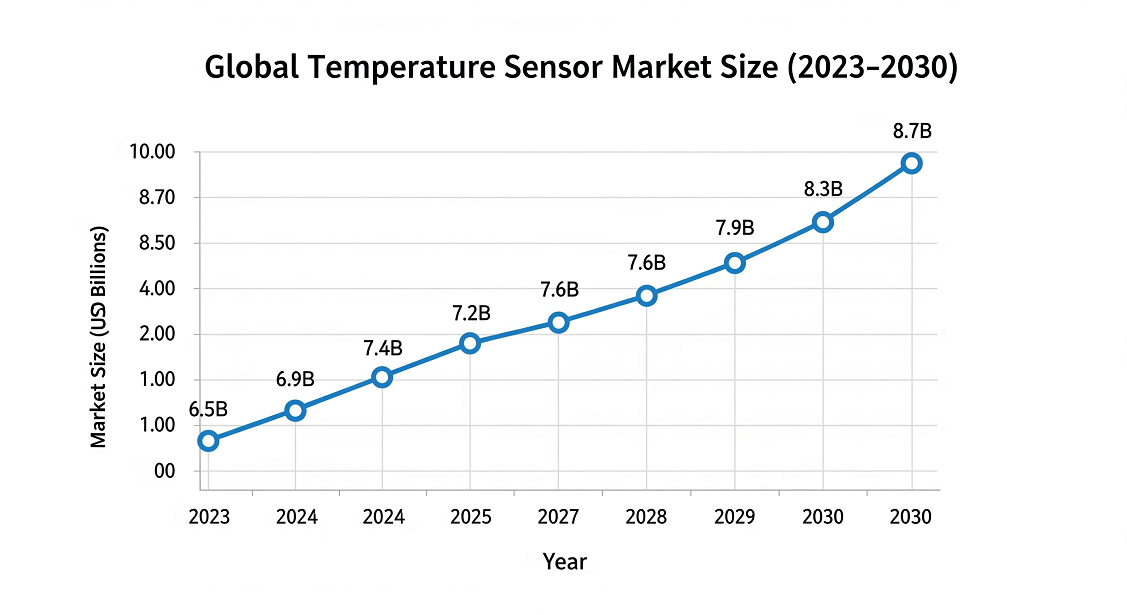

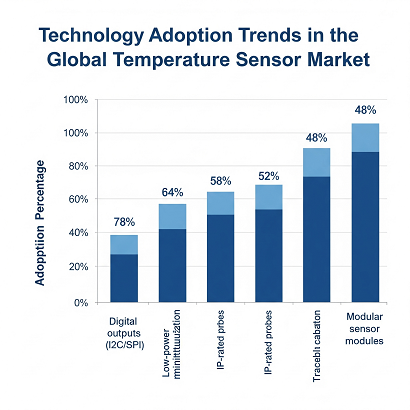

Sep 09, 2025The global temperature sensor market is a critical supply chain segment for electric vehicles, industrial automation (IIoT), medical wearables, and food safety systems. In 2025 the market is characterized by three major trends: (1) digital outputs and system integration, (2) miniaturization and low-power designs for wearables, and (3) industrial-grade robustness and traceable calibration for regulated markets. This guide lists the top 10 temperature sensor leaders, provides Europe-focused procurement tactics to balance higher performance and cost-efficiency, and includes charts and a procurement checklist you can download and reuse.

Use the images and checklist below on the article page to improve engagement, dwell time, and on-page SEO. All image alt attributes include the main keyword global temperature sensor market.

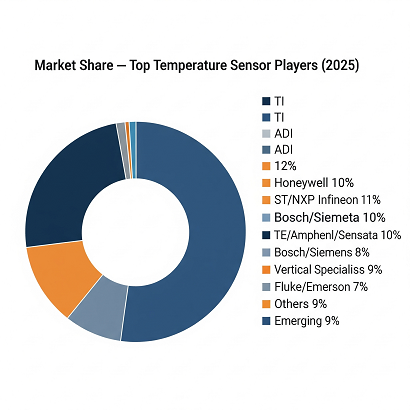

Below are the vendors to benchmark when building RFPs or evaluating supplier options. This list blends semiconductor IC leaders, probe/connectivity specialists, and vertical thermistor/RTD specialists.

The global temperature sensor market continues to grow steadily. Buyers should expect pricing and lead-time pressure as EV and IIoT demand increases. The most impactful technology shifts are:

Sensors with I²C/SPI or standardized digital interfaces are now preferred because they reduce host-side calibration work and speed product development.

Wearables and portable medical devices need very small SMD thermistors or digital temperature ICs that consume minimal energy.

Industrial and regulated buyers increasingly require IP-rated probes, vibration resistance, and NIST-traceable calibration certificates for audits and long-term reliability.

European buyers commonly require both higher performance and cost efficiency. Use these operational tactics to design RFPs and acceptance tests that reflect European expectations.

Classify measurement points in your system: designate critical control points (e.g., battery cells, process inlets) to use high-precision RTD probes with traceable calibration, and permit thermistor or commodity digital sensors for non-critical ambient or redundancy locations.

Include NIST-traceable (or equivalent) calibration certificates in procurement requirements for critical sensors, and specify 3-point calibration if the operating range is broad.

Mandate incoming sample testing and temperature cycling (e.g. 100–500 cycles depending on application). Keep batch IDs and test reports attached to shipments for auditability.

Use brand-name ICs for sensing and signal conditioning, and source probes/packaging from vertical specialists to optimize cost, lead time, and customization.

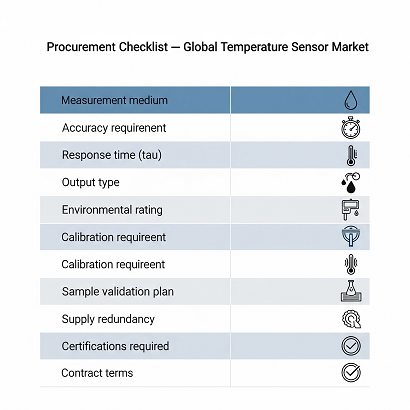

Use the checklist CSV (download link above) as an RFP attachment. Key items you must include:

| Item | Description |

|---|---|

| Measurement medium | Gas / Liquid / Solid contact |

| Accuracy requirement | e.g., ±0.1°C, ±0.5°C |

| Response time (tau) | Specify thermal mass or tau in seconds |

| Output type | Analog (4–20 mA) or Digital (I2C/SPI) |

| Environmental rating | IP rating, vibration and chemical exposure |

| Calibration requirement | NIST-traceable / 1- or 3-point as needed |

| Sample validation plan | Thermal cycling (100–500 cycles), batch traceability |

| Supply redundancy | At least two qualified suppliers for key parts |

| Certifications required | CE, RoHS, AEC-Q200, medical ISO if applicable |

| Contract terms | Warranty, returns, sample rejection criteria |

For mission-critical applications, calibration is mandatory. Best practices include:

Short answer: define the environment, required accuracy, response time and traceability. Choose RTD for long-term stability and calibration, thermistor for compact or low-cost designs, and digital sensors for direct system integration. Validate with sample testing and a documented calibration plan.

Consumer/compact devices: thermistor (cost and size advantages).

Lab/medical/critical process: RTD (long-term stability and traceability).

Request NIST-traceable certificates for critical points. Use 3-point calibration for broad ranges and keep calibration documents linked to shipment batch numbers.

Include these links in the article to increase site relevance (internal) and trust (external):

Note: replace internal links with exact product or landing URLs from your site if you prefer different anchors or paths.

If you want, I will: